Investing beyond boundaries

What are Futures/ Futures Contracts. If you find trading interesting already, we are sure that you will find strategy development fun and rewarding. This is because with a longer expiration time, the odds that the contract will end up profitable will increase. Futures and forex trading contains substantial risk and is not for every investor. Upstox Pro mobile app, 5paisa mobile app, Angel one app, and Prostocks app are the other popular and recommended trading apps for beginners to trade in the share market. When the chat rooms grew, other traders could also comment or post questions online, which required a persistent presence in front of the screen and often paying a fee to use the platform. There are two prices specified in a stop limit order: the stop price, which will convert the order to a sell order, and the limit price. Multiplier feature enables faster investment growth. 76% of retail investor accounts lose money when trading CFDs with this provider. Plan your entry and exit points in advance and stick to the plan. Both brokers provide access to all other U. Marketing partnerships. Plus500UK Ltd authorised and regulated by the FCA 509909. Cryptocurrencies are particularly volatile and can drop at any point; therefore, investors are advised to take caution when using leverage as part of their trading strategy, as this could lead to significant losses.

Swing Trading

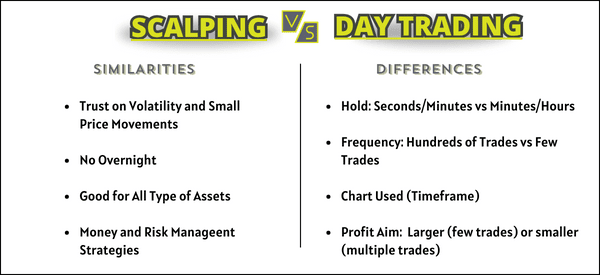

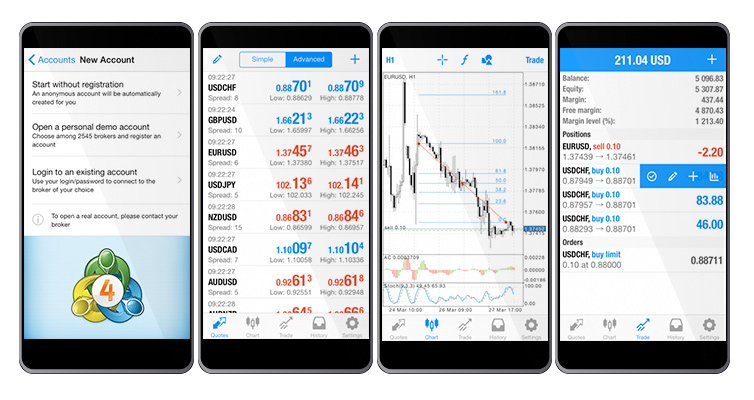

Com mobile, and the popular MetaTrader 4 MT4 app. In July 2007, Citigroup, which had already developed its own trading algorithms, paid $680 million for Automated Trading Desk, a 19 year old firm that trades about 200 million shares a day. They work best in markets that are ranging rather than trending, as the bands can provide potential entry and exit points during price oscillations within the bands. One beautiful thing about the market is that you get to choose the style that works for you – and many styles can be successful. A Double Bottom Pattern is a classic technical analysis chart formation showing a major change in trend from a prior down move. With innovations like ChatGPT and generative AI, AI programs are now offering personalised investment advice. This is often the case with most stocks, ETFs and mutual funds. The announcement comes after eToro reached a settlement with the SEC for charges that the trading platform operated an unregistered brokerage and clearing agency related to its crypto dealings. Following Morgan Stanley’s acquisition of ETRADE in 2020, the company has only continued to advance its capabilities by integrating many of Morgan Stanley’s highly regarded research materials, thought leadership insights, and large pool of financial advisors into ETRADE’s offering. It allows its customers to trade at all three big exchanges, i. We check and evaluate the technical specifications, services offered, latest technologies and updates, user friendliness, cost to benefit analysis, customer ratings, reviews, and satisfaction. That’s the definition of momentum in trading. No, there is no minimum investment amount required to trade on the Appreciate app. Muhurat Trading will be conducted on Friday, November 01, 2024. A Demat account acts as the repository of stocks but to purchase these stocks you will https://pocket-option-ng.click/terms-of-use need to have a trading account. Usually the market price of the target company is less than the price offered by the acquiring company. Scalpers also tend to use bigger lot sizes when opening a position compared to day traders because their positions are kept open for such a short period. Day traders like stocks because they’re liquid, meaning they trade often and in high volume. “The pros are you could make a little bit extra money on investing in the short term,” Moyers says. You don’t need to use all of them, rather pick a few that you find helpful in making better trading decisions. If an asset’s price moves quickly, a trader might start to fear that they are missing out. Like our double bottom pattern, we would initiate a position on the break of the red signal line, set our stop at the highs, and measure the move for a potential target zone. Forex brokers offer a range of leverage options, but not all traders know how to use leverage safely. Here are some key features you can expect to find in a color trading app. You can tailor it to suit your preferences with customizable features such as personalized watchlists of stocks and drag and drop modules. Once you know the timeframe you’re going to trade, you need to determine whether you want to buy or sell a call or put option on the market you’re trading. These implementations adopted practices from the investing approaches of arbitrage, statistical arbitrage, trend following, and mean reversion. Scalping requires account equity to be greater than the minimum $25,000 to avoid the pattern day trader PDT rule violation. When you sell an option, you have an obligation to fulfill the contract. “The History of LSEG”.

Learning the basics of how to trade stocks

FYERS is one of the best trading platforms in India. The answer then becomes something like this. Taking low swings can help a trader who has set a position make profits. There are two types of wedge: rising and falling. We want to clarify that IG International does not have an official Line account at this time. While its cryptocurrency selection is modest, beginners seeking to trade with an established financial institution might find it suitable. A market index tracks the performance of a group of stocks, which either represents the market as a whole or a specific sector of the market, like technology or retail companies. Swing traders care about one thing, and one thing only: finding an opportunity in a short term price swing. No, algorithmic trading is not illegal. Discover our vision, mission and team. These expenses are deducted from the profit or are added to gross loss and the resulting value thus obtained will be net profit or net loss.

Swing trading

Indicator 3: Exponential Moving Average period:300, color: red. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. I agree to terms and conditions. In 2014, the United Kingdom Financial Conduct Authority FCA has raised concerns regarding copy trading as they deem the firms offer copy trading to be effectively unregulated investment managers. The trader seeks help from various types of indicators to take positions. It’s time to place orders with your brokerage when you’ve developed a trading plan and researched a range of stocks. Common stock is most commonly issued by companies and therefore is the most commonly traded. So, you want to become a day trader and join the hundreds of thousands of day traders who are living in the UK. Disclaimer: Always exercise caution while investing in online games and ensure you understand the risks involved. Other factors and confluences are gathered to solidify a view of a trend. Expiration Matching: Align the IV of the index options to the expiration dates of the futures options. We have sent an install link to your WhatsApp. Individuals and businesses use forex trading to protect themselves from unfavorable currency movements. Thanks to its simple, easy to use interface, we found Gemini to be the best crypto exchange for beginners. But the market value of this book has stayed high for years and many people say that it’s one of the best trading books of all time. You’re taking advantage of accelerating time decay on the front month shorter term call as expiration approaches. Technical analysis evaluates the stock based on its past price and volume chart to predict future potential. US Equity Options at minute resolution since 2010, with realistic portfolio modeling. In this strategy, you wait for the stock to put in a series of volatility contractions, then buy on the breakout of the upper trend line. Your capital is at risk. Level 2 data is free to moomoo users that have an approved MFI brokerage account. SteadyOptions has your solution. The market always moves in waves, and it is the trader’s job to ride those waves. Watch our platform demos or join us live every Wednesday at 11 a. And which is the best. When to use it: A covered call can be a good options trading strategy to generate income if you already own the stock and don’t expect the stock to rise significantly in the near future. Simplistic user interface. The option will expire with either some value or be worthless. Love reading their analysis on various stock. This is because you don’t have any additional funds with which to cover your losses.

Reading Price Charts Bar by Bar: The Technical Analysis of Price Action for the Serious Trader

The aspects, described in this article, will not become a revelation for professional traders. Many European brokers, including Interactive Brokers, DEGIRO, and Saxo Bank, offer access to US markets for stocks and options trading. Read our full explainer on what options are. In certain circumstances, a demo account was provided by the broker. This takes discipline of course – sadly, another trait that many traders just don’t have. With our Infinity Investing program, you can explore the world of investing while still taking advantage of all the great features that our company has to offer. Also, make sure to have the latest version of the app and if after all of this you still experience issues, please contact our customer service team and always check the desktop version as well. Open Interest becomes nil past the expiration date for a particular contract.

Stock to buy today: Usha Martin ₹363 3

5 trillion per day in 2022, however, tastyfx LLC is the counterparty to the FX transactions of its client base and therefore serves as the liquidity provider in this much smaller subsection of this marketplace. On the other hand, when liquidity is low, which can be towards the end of the trading session, you need to adopt a more cautious approach to your trade. Understanding the stage where you are is relatively simple process. Indian share markets remain open for equity trading on all weekdays except Saturdays, Sundays, and declared market holidays. 35361, then one pound is worth 1. How AI and machine learning techniques are used in cryptocurrency trading today. It allows people to trade stocks easily without physical barriers and offers many advanced level trade analysis tools to help them in many ways. Anyone worldwide can use it easily. Timing is crucial in commodity markets, where factors like global events and economic indicators influence price movements. Ensure you receive all resources and tools that your stockbroker offers you to benefit from a smooth trading process on time. Here’s how to open your live trading account. By following the right strategies and using reliable tools, traders can maximize their chances of success in intraday https://pocket-option-ng.click/ trading. With IG Market StrategistJingyi Pan. 3 tips to be a better investor. It’s also important to understand the basics of how an option is quoted in popular media, or other online investing tools. It’s known as a retracement when the market experiences a temporary dip. An ineffective trading plan and an ineffective trader are two good reasons to stop trading. The minimum withdrawal amount is ₹110, and you can withdraw up to ₹50,000 per day. Seek appropriate regulations — Is the app regulated by authorities like FINRA or FDIC. No, intraday trading is not a get rich quick scheme.

Aug 16, 2024

Profit targets are the most common exit method. I know they can, but choose not too. The 2010 annotated edition includes commentary by Jon D. The best exchanges offer educational offerings to keep you up to date on all things crypto. We have not established any official presence on Line messaging platform. Here are some of the top schools offering Investing training, including Noble Desktop 2 courses, NYIM Training 2 courses, and NYC Career Centers 2 courses. It’s essential to test your strategy thoroughly and make any necessary adjustments before you start trading with real money. While the broker’s account selection is limited, it lets you open either account at no additional cost except small clearing firms and regulatory agency fees. The ‘going with the flow’ approach will be hard to achieve if you are scared, intimidated or constantly on edge with every change in price. Algorithmic trading strategies involve making trading decisions based on pre set rules that are programmed into a computer. Find out more about how we test. 0 Attribution License. Investment objectives. Investopedia / Madelyn Goodnight. The goal is to profit from short term price movements in stocks, options, futures, currencies, and other assets. The trading session on May 18 will be carried out in two parts. In this article, we will discover what a trading setup is and how a trader can use it for forex trading. CFI offers the Capital Markets and Securities Analyst CMSA® certification program for those looking to take their careers to the next level. This certificate lets you enjoy government trading benefits. Indicators that were once useful such as Polynomial regression Channels are now missing and the last few revisions of the app dont even offer a full screen view of the chart meaning you end up with a small windowed view on an iPad that’s too small to be useful. Open Interest: Open Interest refers to the total number of outstanding positions on a particular options contract across all participants in the market at any given point of time. You acknowledge and agree that in the course of providing “order execution only” OEO trading services to you, Neither MFCI nor their representatives are responsible for making a determination that the products and account types offered are appropriate for you. Basically, it requires an understanding of basics, market knowledge, emotional balance, and analytical and risk management skills. Thanks for this useful information. We check and evaluate the technical specifications, services offered, latest technologies and updates, user friendliness, cost to benefit analysis, customer ratings, reviews, and satisfaction. Further reading: My Changelly review. Explore Best forex brokers with high leverage. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data.

Equity delivery Brokerage Charges

Traders might buy assets when their price is above the VWAP and sell when the price drops below. Minimum deposit and balance. Some traders analyse the stock’s price action to discover their entry and exit points. Here’s the criteria we’ve used to determine the best. This shift allowed for tighter bid ask spreads, making trading cheaper and improving market liquidity. Also, this blog will help you decide what type of account to trade for your first participation. MFCI is a Canadian securities broker specializing in Order Execution Only OEO services. Not representative of all clients and not a guarantee.

Paper Trading Made Easy and Effective

I’m not looking to avoid laws etcetera but, I’m a newbie so go easy isn’t an appeal of crypto to be anonymous from major governments. I’ve found the most effective way to learn is by doing, but learning often means making mistakes, which can be a deterrent to trading when real money is at stake. In intraday trades, you need to square off your position before the market closes. Get matched with a trusted financial advisor for free with NerdWallet Advisors Match. Authorised and regulated by the Australian Securities and Investments Commission License number 541122. Stick to a predetermined number of trades at a time. Scan to Download HFM App in the App Store. Scalping, in the arbitrage sense, is a type of trading in which traders try to open and close positions in very short periods of time in markets such as foreign exchange and securities with the aim of making a small profit from the trades. To trade forex, you need a reputable online broker. Difference Between Cash Flow And Fund Flow. As an Amazon Associate, we earn from qualifying purchases. Nil account maintenance charge after first year:INR 300. The chapters in this Options Trading book include. For day traders, it presents a wide range of opportunities to make quick trades. By staying on our website you agree to our use of cookies. Client is requested to independently evaluate and/or consult their professional advisors before arriving at any conclusion to make any investment. Smaller tick sizes can lead to tighter bid ask spreads, whereas a larger tick size can increase your trading costs but reduce market noise by making price movements clearer. In addition to knowledge of procedures, day traders need to keep up with the latest stock market news and events that affect stocks. Thumbs up for the easy remittance. A basic understanding of the concepts involved with trading and investing will help them lessen their risk and improve gains. A study titled “Evaluating Short Term Trading Strategies on Intraday Time Scales: A Comparison of Candlestick Techniques on the SandP 500” published by Sahin and Akpinar reported that a 5 minute candlestick pattern strategy achieved an average annual return of 11. The main aim of a scalper is to make numerous small profits from tens/hundreds of trades. Recognizing this pattern as a bearish reversal signal, the trader placed a short sell order once the price broke below the pattern’s neckline, with a stop loss set above the right shoulder to manage risk. On the other hand, the tick chart will print a new bar for every 1,000 transactions, regardless of the number of contracts/shares they included. For example, in the lead up to the 2008 Global Financial Crisis, financial markets showed signs that a crisis was on the horizon. This strategy requires the studying of price action in comparison to the previous day’s price movements. You’re probably looking for deals and low prices but stay away from penny stocks.

Financial Products

CMC Markets is, depending on the context, a reference to CMC Markets Germany GmbH, CMC Markets UK plc or CMC Spreadbet plc. Registered Office: Kasumigaseki Building 25F, 2 5 Kasumigaseki 3 chome, Chiyoda ku, Tokyo, 100 6025 Japan. User Friendly Interface: Easy to navigate and use. Just like its descending counterpart, you always want to respect your stops if you are wrong on the trade. In other words, it helps you discern and master your own trading psychology. On this platform, colors can be bought, sold, and traded just like stocks, art, or other digital assets. 25, you’d incur a loss. As a derivative product, one of the main drivers of an option’s value is the underlying security or index. The key difference is that day traders will open and close their positions within the same trading session, attempting to extract small but regular profits from minute market moves.