An undergraduate degree will take 2-4 years and can pursue higher-paying positions in the field than those without a credential. Professionals who learn through on-the-job training can grasp essentials after about six months in entry-level roles. Some bookkeepers pursue certified bookkeeper certifications offered by two national bookkeeping associations. The NACPB offers a certified bookkeeping professional (CPB) designation, and AIPB confers a certified bookkeeper (CB) license.

Career Path

This is a great way to gain real-world experience as you become a bookkeeper and, potentially, a bookkeeping business owner. Previous work experience makes finding clients as a bookkeeping business owner much easier. It’s completely possible to become a skilled and successful freelance bookkeeper https://www.quick-bookkeeping.net/inventory-management-methods/ without the need for a specialized degree or lengthy certification. While more education is always a bonus, many successful freelance bookkeepers start right out of secondary school. A few employers offer on-the-job training for bookkeepers by providing internships and placement programs.

How to Make Money Online: 5 Financial Jobs You Can Do from Home

As a bookkeeper, you may also receive client payments and deposit them at your company’s financial institution. Small businesses may prefer to handle their books themselves, but hiring a professional bookkeeper can be helpful. The size and scope of a business will determine whether the company needs a part-time bookkeeper, full-time specialist bookkeeper, or an entire accounting department.

Difference Between Bookkeeper and Accountant

Building positive relationships with clients, understanding their requirements, and providing excellent customer service contribute to the overall success of a Bookkeeper. Client satisfaction https://www.wave-accounting.net/ not only fosters long-term partnerships but also enhances their reputation in the industry. Beyond crunching numbers, a skilled Bookkeeper possesses business acumen and a strategic vision.

Get a bookkeeping certification.

Bookkeepers handle a lot of confidential information, so you need to have a high sense of integrity and transparency. You don’t want to lose clients or ruin your reputation just because of an integrity issue. In addition, since you will manage crucial tasks, such as managing your clients’ taxes, you need to ensure that you comply with the necessary rules and regulations. Bookkeeping focuses on recording and organizing financial data, including tasks such as invoicing, billing, payroll and reconciling transactions.

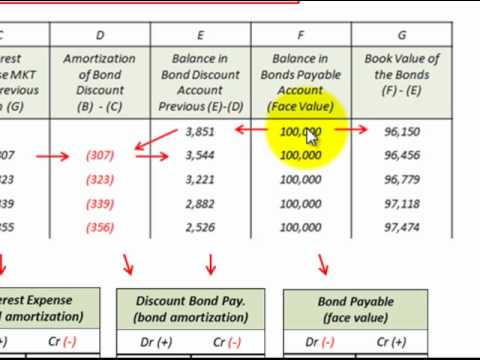

Internships can also provide ways for you to get your foot in the door with a specific organization. Simply put, bookkeepers are responsible for all financial activity and oversight of a business. They record and organize financial statements, new rules for restrictive endorsements ensure compliance with important tax rules, and facilitate all ingoing and outgoing payments on specific business accounts. Every business step requires capital, from transforming an idea into a model to investing in its expansion.

Most employers prefer hiring new bookkeepers who will learn from more senior professionals. Recently hired bookkeepers should expect to receive around six months of guidance and even classroom training when they start their new roles. Employers also prefer to hire bookkeepers who have taken some postsecondary courses. So, some professionals may pursue certificate programs in bookkeeping as a degree alternative. Although you certainly can do formal bookkeeping training (e.g., online bookkeeping courses, relevant degree), many bookkeepers simply learn the ropes through on-the-job training.

- Previous work experience makes finding clients as a bookkeeping business owner much easier.

- They will record financial data into general ledgers, which are used to produce the balance sheet and income statement.

- The use of material found at skillsyouneed.com is free provided that copyright is acknowledged and a reference or link is included to the page/s where the information was found.

- Remember that you are considered as one of the pillars of your client’s financial system, so you must finish your tasks on time.

- A bookkeeper’s job comprises maintaining and balancing financial records, including transactions from coworkers.

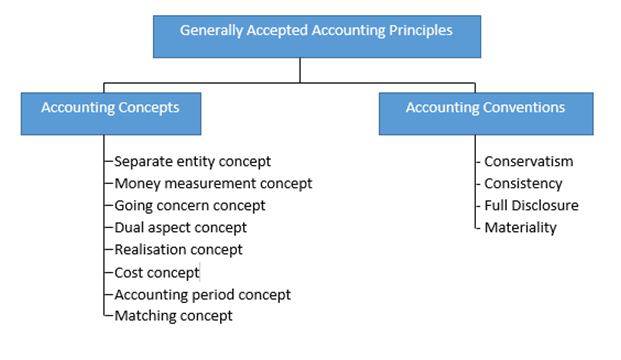

Bookkeepers are integral to ensuring that businesses keep their finances organized. If you’re interested in a career as a bookkeeper, consider taking a cost-effective, flexible course through Coursera. At the end of the course, you’ll receive a professional certificate, which you can put on your resume to demonstrate your skills and accomplishments to potential employers. A business must have bookkeeping processes and policies that keep company records up-to-date and accurate. For example, business owners must be diligent about keeping personal and business finances separate. In addition, smaller businesses may use single-entry bookkeeping, while larger businesses are more likely to use double-entry bookkeeping.

Although software and calculators do most of the math, basic skills such as addition, subtraction, multiplication, and division are essential to helping you catch errors quickly. You typically maintain accurate accounting records across all transactions while communicating with others. A bookkeeper’s job comprises maintaining and balancing financial records, including transactions from coworkers. Both accountants and bookkeepers work to maintain accurate records of finances, and sometimes the terms are used interchangeably. Generally, bookkeepers focus on administrative tasks, such as completing payroll and recording incoming and outgoing finances. Accountants help businesses understand the bigger picture of their financial situation.

While bookkeepers used to keep track of this information in physical books, much of the process is now done on digital software. Bookkeeping is the recording of financial events that take place in a company. Any process of recording financial data is considered bookkeeping and is the first step of data entry into the accounting system.

You can create a custom bookkeeping skills assessment to evaluate your candidates’ understanding of fundamental accounting principles and test proficiency in popular bookkeeping software. They record financial transactions, update statements, and check financial records for accuracy. Many business owners believe they can handle the bookkeeping themselves and to an extent, they are correct.

If you want to become successful in this industry, you need to show your existing and potential clients that you are trustworthy and reliable. Now that you discovered the most important bookkeeping skills and how to assess them, let’s close this article with a few frequently asked questions. Finding the best bookkeeper isn’t easy without testing the right skills for a bookkeeper. Resumes don’t offer the best glimpse into the hard and soft skills of bookkeeping positions. TestGorilla’s Time Management test presents bookkeeping candidates with typical workplace scenarios and assesses their ability to manage their time and prioritize, plan, and execute tasks. The US GAAP test evaluates a candidate’s ability to perform accounting transactions.

One way to think about it is that bookkeepers lay the groundwork for accountants to analyze and prepare financial statements. Mastering the twelve essential Bookkeeping Skills is not merely a professional pursuit; it is a journey towards becoming a proficient and indispensable asset in the world of financial management. From the meticulous attention to detail to the strategic vision required for effective decision-making, each Sk9ill plays a pivotal role in maintaining the integrity of financial records. As technology continues to shape the domain of Bookkeeping, proficiency in using accounting software and navigating data entry processes becomes one of the indispensable Bookkeeping Skills. Also, these professionals stay updated with the latest software and tools to stay ahead in the field.

The IFRS test measures a candidate’s ability to work according to International Financial Reporting Standards. Bookkeepers must be extremely detail-oriented to process financial information and prevent liabilities. TestGorilla’s Numerical Reasoning test measures a candidate’s ability to interpret and work with numbers. In bookkeeping, problem-solving can pinpoint inefficiencies and mistakes and anticipate potential issues. When anomalies or issues occur, bookkeepers can identify them and determine the reasons behind them using relevant information and asking the right questions. Bookkeepers often need critical-thinking skills to help interpret the story behind the numbers.

Their work plays an important role in the operation of a successful business, which can have very many transactions in a single day, let alone a week, month, fiscal quarter, or year. When you apply for a job you can show your bookkeeping skills on your resume and cover letter, as well as during the job interview. In all cases, make sure to specify your type of bookkeeping skills and match them with the job description. A bookkeeper can expect to earn a salary in the range of $30,000-$60,000 a year in the US. However, compensation will widely vary depending on the employer, location, and candidate experience. Bigger companies tend to offer better compensation for bookkeepers; this is largely due to the increased volume of transactions and data.